Holiday Shopping Survival Guide

When the Holiday Season comes around, we shop. We shop for our family, we shop for our clients, our employees, our friends, and because the savings are so good, we even shop for ourselves! Traditions date back to the 1800’s when the first “Black Friday” was sparked by two crafty gold dealers who found a way to corner the market, forcing President Ulysses Grant to flood the market with a surplus of gold to get things back to normal. A relatively new addition to the Holiday Shopping Season, “Cyber Monday” was created in the 2000’s to help boost Internet sales, worked instantly, and will stick around as long as people are buying products online.

With so many consumers visiting local malls and online shopping carts to unload their paychecks, scammers and ne’er-do-wells are sure to follow. Many of their tactics have been around for years; Social Security and credit card scams, break-ins, pickpockets, and phishing, are common occurrences to look out for. Read on for the history of Black Friday & Cyber Monday, and get tips on how to keep your money and privacy secure during the Holiday Season.

The History of “Black Friday”

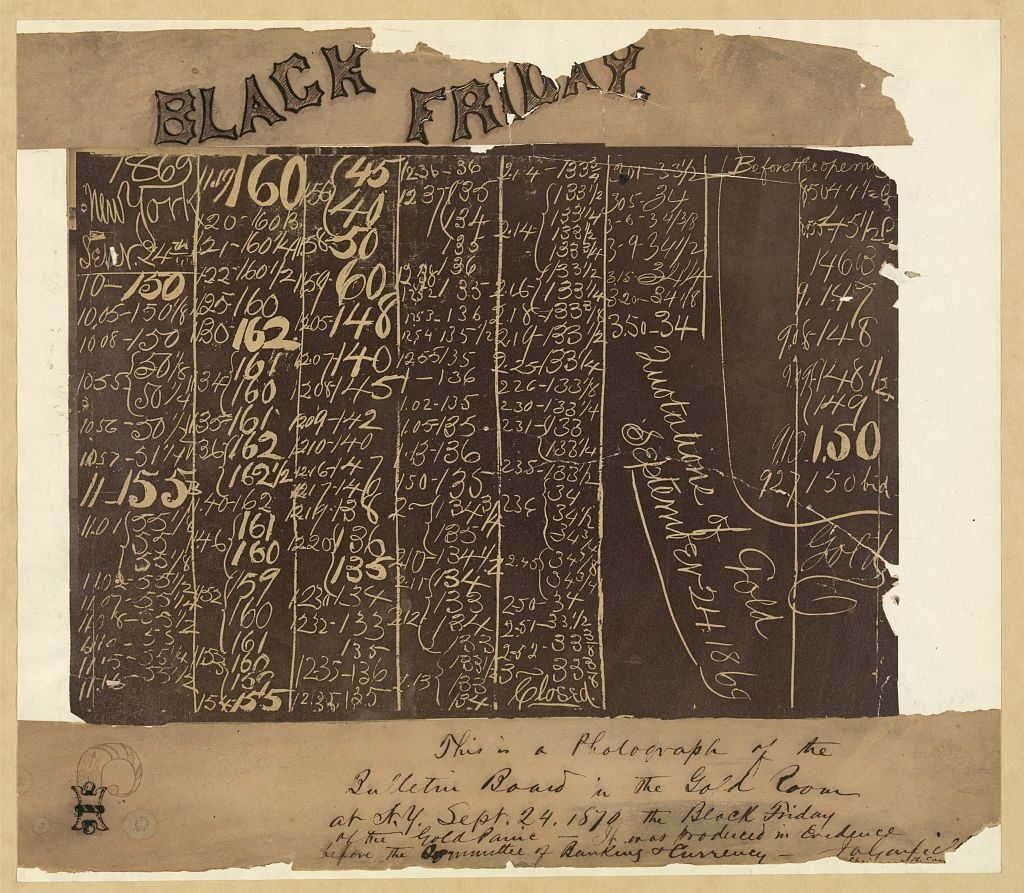

Every fourth Friday of November, cost conscious consumers brave lines and gridlocked parking lots to fill their cars with presents, self-indulgences, and household necessities. The purchasing bonanza is now referred to as “Black Friday,” and many people incorrectly believe that this is because retailers finally get “into the black,” or begin to turn a profit for the year. This may indeed be the case, but the first time the expression “Black Friday” was used in recorded history was in 1869 on a dark day in presidential history and it had nothing to do with shopping.

Ulysses S. Grant, Gold, and a Football Rivalry

On the first “Black Friday,” 147 years ago, two crafty speculators moonlighting as railroad tycoons, James Fisk and Jay Gould, attempted to combine their newly formed wealth to drive up the price of gold by buying as much as they could without anyone noticing. At the same time, the two men conspired with President Ulysses S. Grant’s assistant treasurer to get inside information that helped them manipulate the New York Gold Exchange. All summer the price of gold soared and stock prices plunged. Fisk and Gould—who worked closely with the notoriously corrupt Boss Tweed and Tammany Hall—made a fortune.

When the federal government realized what was happening President Grant was humiliated and forced to sell $4,000,000 of federally held gold reserves (or over $70 million today) to normalize the market, but it was not enough—millions of dollars of wealth disappeared as a few fortunes were made, but many more were lost, including the savings of the middle class. The term “Black Friday” became a cliché to describe any Friday disaster, no matter how large or small.

In 1950s Philadelphia, “Black Friday” was the day before the annual Army-Navy football game, when rowdy fans from New York and Maryland would fill the city’s hotels, restaurants, bars, streets and stores. Thirty years later, noticing an uptick in sales on the Friday after Thanksgiving, retailers decided to flip the script and market “Black Friday” as the sales event of the year. It took over thirty years, but finally the marketing plan of some anonymous capitalist has worked beyond anyone’s wildest imagination.

Black Friday Today

Today, on “Black Friday,” hundreds of millions of consumers spend more money than on any other day of the year. But this has only been true for the last decade and in 2014, in-store spending was actually down 11% from the prior year. Still, down 11% meant $50.9 billion in sales, (including the weekend). Last year was a different story altogether, as shoppers broke the “Black Friday” in-store spending record, laying down a cool $67.5 billion at the counter (or on average $403 a person), which was $8 billion more than the previous record in 2012.

Recent Black Friday sales numbers can be linked to several factors; the start of holiday shopping, heavily discounted merchandise, sensationalized marketing strategies, and along with most companies, 24 states in the U.S. celebrate the day after Thanksgiving as a holiday, giving the vast majority of U.S. workers a four-day weekend. But as much as retailers and shoppers enjoy the enormous profits and sales that roll in on “Black Friday,” the day has not been good for the public’s well being. Over the past ten “Black Fridays” seven deaths have occurred in addition to nearly 100 injuries. Many consumers put themselves at risk by spending the night camped out to secure a place in line for first crack at the best deals, which often lead to the stampedes that we see every year on local news.

The most notorious case was in 2008, when around 2,000 people gathered overnight outside of a Wal-Mart in Long Island, New York. That November morning at 5:03 a.m. tragedy struck when the crowd, worked into a frenzy, broke down the front door of the Wal-Mart and plowed over a 34-year-old employee, trampling him to death. On that same tragic “Black Friday” two people were shot and killed at a Toys ‘R’ Us in California. Although these are extreme anecdotes of what have happened on “Black Friday,” and events of this nature are rare, it is good to be prepared for what you may find when shopping on the day after Thanksgiving.

14 Safety Tips for Shopping on “Black Friday”

- For your safety; officials recommend taking only one credit card to shop instead of paying with cash, multiple credit cards, or a debit card.

- Before heading out; make photocopies or take pictures of your credit card (front and back) so you will have the account number and contact information needed if lost or stolen.

- Report stolen or missing credit cards immediately.

- Laws protecting consumers from unsafe shopping conditions are in place so that if you face injury while shopping, a claim can most likely be filed against the store or landlord.

- Police officials across the country are asking shoppers to be careful, not to rush, and be respectful to other customers on “Black Friday,” especially when facing large crowds.

- Always ask about return/refund policies before making a purchase.

- Identity thefts and frauds increase this time of year. Do not take your credit card out until payment is ready to be accepted and keep your wallet close at hand.

- Do not bring any unneeded credit cards or information like your social security card.

- Do not give out your social security number unless you are applying for a new credit card or entering into a pay-over-time contract directly with the retailer.

- Check your receipt before leaving the store and make a copy or take a picture with your phone when you get home.

- Purchase gift cards directly at the retailer to avoid scams.

- Lock all purchases in the trunk—do not leave them visible and unattended in the back seat.

- Bring water and snacks. Many injuries reported on “Black Friday” are related to dehydration.

- Here’s a little known secret: most retailers slash prices again on the Saturday before Christmas, driving prices even lower than on the fourth Friday of November.

The History of “Cyber Monday”

“Cyber Monday” was imagined by a lobbyist in Washington D.C. just over a decade ago and since then sales have increased year after year. In 2006, the first “Cyber Monday,” a new online version of “Black Friday,” was pitched to consumers in the form of million-dollar marketing campaigns and they worked. On the first Monday after Thanksgiving deemed “Cyber,” online sales increased by more than 25% from 2005, surpassing $600 million in sales. In this made-up holidays fourth year, “Cyber Monday” 2010, online retailers broke $1 billion in sales and in 2015 consumers tripled that number when they spent over $3 billion.

The concept was apparently the brainchild of Ellen Davis, a senior vice president at the National Retail Federation (NRF), one of the most influential conservative lobbying trade groups in D.C. “Cyber Monday” was first announced through their press release in November 2005 titled, “Cyber Monday Quickly Becoming One of the Biggest Online Shopping Days of the Year.” Even though it wasn’t one of the biggest—not even in the top ten—that headline became prophetic. Five years later in 2010, “Cyber Monday” became the largest day for online spending that year. This was accomplished with help from the media, spearheaded by the New York Times, who legitimized the retail trade association’s claims on November 19th 2005, with an article titled, “Ready, Aim, Shop.”

NRF’s affiliate, Shop.org, released the November 2005 statement that read, “While traditional retailers will be monitoring store traffic and sales on Black Friday (the day after Thanksgiving), online retailers have set their sights on something different: Cyber Monday, the Monday after Thanksgiving, which is quickly becoming one of the biggest online shopping days of the year.” The New York Times confirmed that there was a “trend” by using the NRF’s own numbers from the press release in their reporting.

“Though it sounds like slick marketing, Cyber Monday, it turns out, is a legitimate trend,” wrote Times writer Michael Barbaro. “According to Shop.org. a trade group, 77 percent of online retailers reported a substantial sales increase on the Monday after Thanksgiving last year.” The vast majority of products sold on “Cyber Monday” are related to the fashion industry who are a leading advertiser with the paper.

In a recent survey, 40% of U.S. consumers said that they are planning on taking part in “Cyber Monday,” but only 22% said that they would do the majority of their holiday shopping online. The concept of “Cyber Monday” was exported to Canada and France in 2008, the United Kingdom in 2009, and to Japan in 2012 after Amazon announced Japan’s Anniversary Association had approved their request to celebrate an online day for consumers. In 2013, both Forbes and CBS News announced that “Cyber Monday” had officially transformed into “Cyber Week,” giving consumers more time to shop and cyber criminals more time to steal identifies.

10 Safety Tips for Shopping on “Cyber Monday”

Staying at home to avoid Black Friday crowds is a smart idea, but that doesn’t always mean your day will be free of security issues. Scammers are sitting at home as well, trying to reach their hands into the pockets of consumers on Cyber Monday. Here are 10 tips to help keep your email and bank account away from attackers.

- Consumers should watch out for fake websites that mirror the brands actual site with significant deals and an identical paywall.

- Before entering your payment information make sure that the URL starts with “https” and that you are on the brand’s official website.

- Make purchases with a credit card because the consumer protection is far greater than with a debit card.

- Be on the lookout for an uptick in phishing emails that look like they are coming from one of your trusted brands like your bank or credit card provider. Check the sender of the email before clicking on any links, including the “unsubscribe” button.

- Never shop or sign into your bank account using public Wi-Fi. Fake hotspots are often setup in busy metropolitan areas to lure consumers into entering their sensitive information.

- Shopping on your cellphone is convenient, but 3G and 4G networks are more susceptible to hackers than shopping through private Wi-Fi at home on your laptop.

- Always use Paypal when shopping on Ebay to avoid fraudulent sellers.

- Contact your bank immediately if you have been taken advantage of by a scam. If you reach your bank before the money has transferred they can stop the transaction.

- If you do fall victim to a scam find your local consumer protection office here: https://www.usa.gov/state-consumer

- To fill out a consumer complaint against a company with U.S. authorities visit: https://www.usa.gov/consumer-complaints

Closed for Thanksgiving & Black Friday

The week of Thanksgiving has become more and more important to the U.S. economy, but many companies have opted out and closed their doors on turkey day. Laws in Massachusetts, Maine, and Rhode Island, mandate that all large supermarkets, big box and department stores are closed for the holiday, but a few companies have decided to go farther and announced that they will be closed the day after as well.

Recreation Equipment Inc. (REI), a consumer co-operative based in Kent, Washington, has once again led the movement and will close all 149 of their locations on both Thanksgiving and “Black Friday,” while still paying more than 12,000 employees for the vacation. Like most movements in 2016, opting out of “Black Friday” comes with a hashtag.

#OptOutside, created by REI, came with the message of exploring the outdoors with loved ones instead of buying them presents. This year, according to their website, 1.9 million consumers have promised to #OptOutside instead of shopping. In addition to REI, another Washington state apparel and gear company, Outdoor Research, will close their doors on both Thanksgiving and “Black Friday” as well.

Retailers Not Participating in Black Friday (2016)

Stores like Macy’s are open for longer hours this Thanksgiving (Macy’s opens at 5 p.m. and closes at 2 a.m. then reopens for “Black Friday” at 6 a.m.), but the 35 stores below will be closed for the entire day so that their employees can spend the holiday with their families:

- A.C. Moore

- American Girl

- Barnes & Noble

- BJ’s Wholesale Club

- Burlington

- Chico’s

- Costco

- Crate and Barrel

- Dillard’s

- DSW

- GameStop

- Guitar Center

- Hobby Lobby

- Home Depot

- Home Goods

- IKEA

- Jos A. Bank

- Lowe’s

- Mall of America

- Marshalls

- Neiman Marcus

- Office Depot

- OfficeMax

- Outdoor Research

- P.C. Richards

- Patagonia

- PetSmart

- Pier 1 Imports

- Publix

- Raymour and Flanigan

- REI

- Sam’s Club

- Staples

- The Container Store

- T.J. Maxx